Trump uncensored!

In a live comment for reporters, Trump showed the extent of his frustration that Israel and Iran continued to fire upon each other violating Trumps efforts towards ceasefire negotiations.

If you choose to listen to the comment, please be warned that there is strong language.

https://www.bbc.co.uk/news/videos/cwygp9d44zeo

Oil prices fell after Trump says China can continue buying oil from Iran.

The statement surprised oil traders and officials in Trump's own government.

“China can now continue to purchase Oil from Iran,” Trump said in a post on his social media platform Truth Social. “Hopefully, they will be purchasing plenty from the U.S., also. It was my Great Honor to make this happen!” Trump threatened in May to ban any country that buys Iranian oil from doing business with the U.S. China purchases the vast majority of Iran’s oil exports.

The war risk premium for crude oil is diminishing rapidly. If the truce remains intact, prices are expected to stay under $70.

OPEC is preparing for an additional increase in crude supply, even as prices have fallen after the Israel-Iran truce.

According to initial assessments from the Pentagon, US airstrikes did not eliminate Iran's essential nuclear infrastructure located underground, but they reportedly delayed the program by several months to a year. The UN watchdog has called for new inspections of the facilities.

White House officials have rejected these claims as inaccurate, while Donald Trump asserted that the nuclear sites are "entirely destroyed."

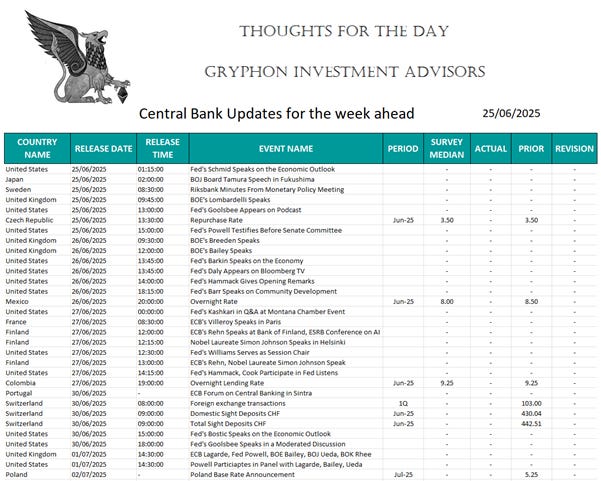

Fed's Powell statement and Q&A to Congress

Treasuries are on the rise, with yields on bonds ranging from three to 30 years decreasing, as Powell emphasizes that a rate cut in July remains a possibility, dependent on -- and this is a vital condition -- a reduction in inflation.

Naturally, bond traders who are keeping an eye on the June employment data, set to be published next week, will push more fervently for a rate cut in July if the hiring statistics fall considerably short of expectations.

Powell stated in his prepared remarks that inflation continues to exceed the 2% target and that inflation expectations have increased as a result of Trump's tariffs, while suggesting that the effects of these tariffs on inflation might be "short-lived."

Powell's prepared statement closely mirrors the wording from his June press conference, and therefore, it can be interpreted as a courteous rejection of the FED’s Waller and Bowman's efforts to actively consider a rate cut in July.

Powell emphasizes that there is no urgency to lower interest rates as the Federal Reserve seeks clarity on tariffs. He describes the economic outlook as 'highly uncertain.'

During the hearing, the Fed chair refrains from discussing tariffs and tax policy.

Powell directly attributes the lack of rate cuts to the uncertainty caused by tariffs.

“We haven’t fully restored price stability,” Powell says. He says they “need to be careful in case there is another inflation shock.”

Powell says that if inflation is contained, they would cut “sooner rather than later.” and

“We don’t need to be in any rush.”

“It’s just a matter of being prudent and careful,” Powell says on not yet cutting rates.

He reiterates they would act sooner if the labour market weakens.

Powell states that initially, it is the importer who bears the cost of tariff increases. However, over time, five distinct parties are involved:

• manufacturer

• exporter

• importer

• retailer

• consumer

All available data indicates that at least some of the tariffs will ultimately be passed on to consumers.

Powell reiterates his belief that the US federal budget has been on an unsustainable trajectory "for some time now." However, he refrains from making any further comments concerning fiscal policy. The context here is the worry expressed by numerous economists that the Republican tax-and-spending legislation will increase US deficits.

Democrat Jim Himes from Connecticut, who previously worked as an investment banker at Goldman Sachs, inquires about the dangers posed by fluctuations in global energy prices. Himes raises the concern of oil prices reaching $120.

“We would certainly feel that,” Powell says.

Powell mentioned that inflation might not be as robust as anticipated, and that a decrease in inflation along with a softer labour market could lead to an earlier reduction in interest rates. However, he also indicated that there are numerous potential trajectories moving forward.

Powell refrained from commenting on Waller's statements regarding the economy and the potential for rate cuts as soon as July. However, Powell did state, " it’s possible the Fed could cut interest rates sooner if the labour market weakens, or more slowly if it strengthens.”

Marlin Stutzman, a Republican from Indiana, addresses the housing market, a topic that several committee members have recently highlighted. He points out that many homeowners seem to be "stuck" due to the low interest rates they secured in previous years, which makes them less inclined to sell. Powell confirms that indeed, "people are locked in."

Powell is receiving numerous inquiries regarding housing, yet he is striving to downplay the Federal Reserve's influence. He recognizes that interest rates can impact housing demand, but he emphasizes that their effect on supply is limited, asserting that the overall economy plays a more significant role.

When asked about the significance of independence and what his primary worry would be regarding a successor who fails to uphold that independence, Powell stated,

“The credibility of the Fed on price stability is very very important”, Powell says. If that credibility was lost, long-term rates would go up and it would be “expensive” to restore that credibility.”

US Consumer Confidence, Present situation and Expectations data were released, all significantly below prior numbers and the surveys. The renewed deterioration in confidence in June is striking. Lower confidence comes amid renewed concern regarding the labour market, lower income prospects and about the economy in general. Inflation expectations also edged slightly lower.

U.S. existing home sales rose 0.8% in May, slightly beating expectations, while the median sale price hit a record $422,800, up 1.3% YoY. Inventory grew over 20% from a year ago, but homes are taking longer to sell and mortgage rates remain high.

Trade Negotiations Update.

• Trump announced that he will establish tariff rates for US trading partners in the coming weeks, citing an inability to negotiate agreements with everyone.

• The US administration has established a framework to engage in negotiations with 18 countries, six each week, over a span of three weeks, in a rotating manner until the deadline for pausing reciprocal tariffs on July 8.

• Finance ministers and central bank governors from the G7 countries committed to tackling "excessive imbalances" in the global economy, with the goal of establishing a fair playing field and enhancing transparency.

• Japan's Prime Minister Ishiba stated that he will not compromise Japanese national interests for a quick trade agreement with the US, emphasizing that the outcome of such a deal hinges on US President Trump's choices. Ishiba conveyed to a leader of a Japanese opposition party that the US's intense focus on its auto trade deficit is a significant barrier to an agreement between the two nations. During the G7 meeting, no trade deal was finalized between Trump and Ishiba. Trump remarked that he had a productive discussion with Japan regarding trade, while Ishiba urged him to rethink the tariffs. Previously, Ishiba had indicated that investing in the US holds greater importance than the tariffs themselves.

• Previously, Japan PM Ishiba said Japan will not accept a trade agreement with the US that excludes an accord on autos.

• The EU intends to impose retaliatory tariffs should Trump establish baseline levies on the bloc, according to sources familiar with the matter.

The European Union is hurrying to finalize an agreement with Washington prior to the increase of tariffs on almost all its exports to the United States, which are set to rise to 50% on July 9. However, many anticipate that the majority of US tariffs will stay in effect even if an agreement is achieved.

In retaliation to US tariffs, the EU is readying tariffs on $116 billion worth of US products and will evaluate the results of any agreement to determine its response, which must be coordinated with its member states.

• Canada will announce its counter tariffs on steel and aluminium on July 31. Also, Canada will establish 100% of 2024 levels.

• Mexico President Sheinbaum said she had offered Trump an agreement on trade, security and immigration.

• The US and Mexico are closing in on a deal that would remove 50% tariffs on steel imports up to a certain volume.

• India and the US are engaged in negotiations to finalize an interim trade deal before July 9.

• US President Trump threatened to impose 25% tariffs on Apple if iPhones are not made in the US. Previously, Apple aimed to import most of the iPhones it sells in the US from India by the end of 2026.

• On April 21, the U.S. and India announced they had agreed to broad terms of negotiation for a potential bilateral trade deal. The US will seek increased market access, lower tariffs and non-tariff barriers, and a robust set of additional commitments

• A US-India trade agreement under discussion covers 19 categories, including market access for farm goods, e-commerce, data storage, and critical minerals.

• Negotiators will discuss contentious issues like agricultural tariffs, e-commerce market access, data storage, and critical minerals, with the goal of boosting bilateral trade to $500 billion by 2030 from $127.6 billion last year.

• On June 9-10, US Commerce Secretary Lutnick and Treasury Secretary Bessent held trade talks with China Vice Premier He in London. Both sides said they have reached an agreement after the trade talks, pending approval from US President Trump and China President Xi.

• Reuters reported the trade agreement left rare-earth export restrictions tied to national security unresolved as China hasn’t committed to granting export clearance for certain rare-earth magnets needed by US military suppliers.

• US officials signalled they may extend existing tariffs on China for a further 90 days beyond the August 10 deadline.

• During May 10-11, US Treasury Secretary Bessent met China Vice Premier He and reached a de-escalation agreement. The US lowered tariffs on China imports to 30% including 10% universal tariffs and 20% Fentanyl tariffs. Other universal tariffs including 25% on steel and aluminum and 25% on autos and auto parts have remained in place. Meanwhile, 24% reciprocal tariffs will be suspended for 90 days to allow for further negotiations with a deadline on August 10.

• Trump and UK Prime Minister Starmer reached an agreement to implement parts of the trade framework. The agreement includes:

• Exempting UK’s civil aerospace aircraft sector from the 10% universal tariffs.

• UK car makers will be allowed to export 100k cars to the US with a 10% tariff, down from 27.5%.

• UK farmers will be given a tariff-free quota for 13,000 metric tons of beef exports.

• However, UK’s steel and aluminium are still charged with 25% tariffs, though lower than the 50% tariffs the US imposed elsewhere.

European Defaults Hit 4.4% on Altice default.

The index default rate hit 4.4% after Altice France defaulted, with five bonds and €3.7 billion par rated D.

UK Manufacturing orders fall in June.

The CBI Industrial Trends Survey total orders balance fell to -33 in June, from -30 in May, below the consensus, -24.

Chinese companies are increasing their shipments to the UK to levels not witnessed in years, indicating that businesses are discovering export markets unaffected by Trump's tariffs.

Malaysia's May CPI inflation slowed to 1.2% y/y vs. consensus forecast for a steady 1.4% pace and the slowest since February 2021 amid lower global oil prices.

Australia's inflation rate decreased more than anticipated in May, reaching 2.1% year-over-year, strengthening the argument for a potential rate cut as early as next month.

China's U.S. Treasuries holdings just plunged to the lowest level since 2009.

China aims to enhance the global significance of the yuan, capitalizing on what officials perceive as a unique strategic opportunity amid the dollar's decline.

ECB Can Still Cut Rates in Next Six Months, Villeroy Says – Policymaker Francois Villeroy de Galhau said the ECB could still cut interest rates in the next half year. “If we look at the present assessment of markets so far, inflation expectations remain moderate,” the Bank of France chief said in an interview with the Financial Times published Tuesday, echoing comments from last week. “If that was confirmed, it could possibly lead in the next six months to a further accommodation.”

Germany is set to borrow approximately 20% more than initially planned in the upcoming months to support a significant increase in expenditures, with the finance agency targeting €118.5 billion for the period from July to September.

The government published the 2025 draft budget and plans for 2026-29, indicating a large increase in defence and investment spending.

The government's mid-term financial strategy outlines net new borrowing of around €500 billion over the next five years, extending through 2029, with an emphasis on strengthening the military and revitalizing the economy.

The cabinet has sanctioned this year's budget, which allocates just over €500 billion for spending and anticipates net new debt of €82 billion, alongside intentions to boost investments in both internal and external security, while progressing towards NATO's objective of dedicating at least 3.5% of GDP to fundamental military spending.

Most of the increase in investment spending will be financed through the infrastructure fund. The focus of increased investment spending will be on transport infrastructure and notably railways.

Zero….

The Swiss National Bank has reduced its interest rate to zero and has not dismissed the possibility of lowering borrowing costs into negative territory in the future (although it emphasized that this is not a decision it would take lightly).

Switzerland is on the brink of experiencing negative interest rates for the first time since 2022.

Government bonds, up to 4 year maturities are already providing negative yields.

Investors are essentially paying to lend money to the Swiss government - a situation that contradicts all economic theories.

Conversely… the world views Switzerland as the ultimate safe haven - and this perspective is understandable.

It’s no surprise that the Swiss franc remains so robust. High interest rates are not a prerequisite for that.

Amazon will invest £40B (USD $54B) in the U.K. over three years to build four new fulfilment centres and to upgrade operations, creating thousands of jobs as it expands logistics, data, and film infrastructure across the country.

FedEx plunged on a weak profit forecast for this quarter.

Ford continues to face rare-earth magnet shortages despite a U.S.-China export deal, disrupting its EV production. Limited export license approvals also threaten further delays as China controls ~90% of the global supply.

Monte Paschi received ECB approval for its takeover bid of Mediobanca.

Starbucks denied reports of a full China exit but says it is exploring options, including selling a stake in its China unit. Facing intense price competition, its China market share dropped from 34% in 2019 to 14% in 2024.

Top Chinese think tank wants stablecoins to drive Chinese yuan internationalisation.

A top economist from one of China’s most prestigious think tanks argues that Beijing has no choice but to embrace the latest advances in cryptocurrency and blockchain technologies.

Li Yang, the deputy-head of the Chinese Academy of Social Sciences (CASS) and the director of National Institution of Finance and Development (NIFD), has called for the development of offshore renminbi stablecoins, to drive internationalisation of China’s official currency.

Li Yang argues that China has no choice but to embrace the latest cryptocurrency and fintech innovations, given the transformative impact they’re poised to have on the world’s financial and monetary systems.

“Stablecoins and cryptocurrencies will achieve complementary development with central bank digital currencies.

“They will reshape the global payments system and drive defi development…[they will] comprehensively improve payments efficiency and reduce payments costs.”

Li argues that realisation of the need for the integration of stablecoin, cryptocurrency and central banking systems is fast becoming universal across the world’s leading economies.

“Just several years ago, certain countries only supported central bank digital currency testing, while others focused their support on stable coin and cryptocurrency innovations.

“Recently however, most of them have shifted to a model of supporting the joint development of all three…the EU Japan, Dubai, Singapore and Hong Kong are all classic examples of supporting integrated development.”

In sharp contrast to cryptocurrency advocates who touts the ability to radically decentralise financial systems, Li is most impressed by the potential for stablecoins to enhance the reach and power of state-backed fiat monies.

Stablecoins are a type of digital asset that are nominally pegged to a reference asset which can assume multiple forms - including fiat money, other cryptocurrencies, or real world commodities.

Li views them as a critical means for extending the functionality and power of the incumbent currencies produced by the monetary authorities of national governments.

He points in particular to the example of US stablecoin usage.

“Stablecoins are not a newly emerging, independent currency, but in fact a technological upgrade and power extension for the US dollar system in the digital era," Li writes.

“Their rise highlights the core status of payments and clearing functions and the key role of accounts systems.”

JPMorgan Chase revealed plans to pilot a ‘deposit token’ called JPMD on Coinbase’s Ethereum layer-2 network Base.

JPMorgan’s JPMD token is a USD-denominated deposit token issued by the bank’s blockchain division, Kinexys. It is not a stablecoin for the general public, but rather a permissioned on-chain representation of institutional deposits held at JPMorgan. JPMD mirrors internal bank balances between institutional clients, potentially replacing legacy banking settlement systems with blockchain-based infrastructure. Unlike relatively permissionless stablecoins like USDt or USDC, JPMD operates in a closed, controlled ecosystem for known participants. Further separating JPMD from stablecoins is that the token reflects JPMorgan’s traditional banking model utilizing fractional reserves, rather than full-reserve backing typical of stablecoins.

Japan's Financial Services Agency proposed reclassifying crypto as 'financial products' under the Financial Instruments and Exchange Act. The development would allow for crypto ETFs and a flat 20% tax on digital asset income, replacing current tax rates of up to 55% to align crypto with stock taxation.

Crypto hardware wallet provider Ledger announced Recovery Key, a physical backup for emergency recovery of wallets. The feature enables users of Ledger Flex and Ledger Stax to quickly recover their crypto wallets by tapping a card and entering a PIN.