Iran said its nuclear installations were “badly damaged” by American strikes, the AP reported. Donald Trump disputed a Pentagon assessment that found the attacks had a limited impact on its nuclear program, calling news reports about it “fake.”

The US strike on Fordow left the facility “inoperable,” the Israel Atomic Energy Commission said.

At the NATO summit, the president said he thinks the Iran-Israel war is “over.”

President Trump orchestrated the assault on the US military base in collaboration with Iran.

Trump essentially manages everything.

Trump said at the Nato meeting:

“Iran was very nice, they gave us warning. They said we’re going to shoot them. ‘Is 1 o’ clock ok?’

“They fired 14 high end missiles at us.”

“Everyone was emptied off the base. All 14 missiles were shot down by own equipment.”

“Countless lives were saved.”

NATO leaders agreed to boost defence spending to 5% of GDP and reaffirmed their mutual defence commitment. The decision marks a major win for Trump, who earlier expressed support from the bloc.

The 5% target is split:

3.5% for conventional defence: personnel, operations, and crucially, equipment (e.g. tanks, aircraft, missiles).

1.5% for non-conventional defence: infrastructure protection, cyber defence, civil resilience, and industrial base support.

NATO's allocation of 1.5% towards the safeguarding of infrastructure and networks, civil readiness, and industrial robustness embodies a contemporary perspective on national security.

Today, defence encompasses the safeguarding of data centres, energy grids, undersea cables, satellites, and supply chains—not merely tanks and soldiers. NATO's emphasis on "network protection" indicates a significant, long-term transition towards cyber, digital, and infrastructure resilience.

After Spain agreed a veto of the 5%, Trump has vowed to talk with them directly!!!

Trump may increase tariffs on Spain, who doesn't want any tariffs and desires lower defence spending (don't know how this can be done in context of EU).

Trump: We're negotiating with Spain on trade deal. We will make them pay twice as much.

Secretary General of NATO, Mark Rutte, calls President Trump “Daddy” after Trump discussed how he got Israel and Iran to agree to a ceasefire.

Rutte: “And then Daddy has to sometimes use strong language.” It makes you cringe!

As the race hots up to eventually replace Fed Chair Powell at the end of his term, Trump was quoted as saying, “Powell is low IQ for what he does, a mentally challenged person; a very stupid person; probably a very political guy I guess, I think he is a very stupid person actually.”

No love lost there then!

Trump is contemplating Kevin Hassett and former Fed governor Kevin Warsh, according to a report by the WSJ. Additionally, Scott Bessent is being recommended. Former World Bank President David Malpass and Fed Governor Christopher Waller are also part of the discussion.

The dollar and Treasury yields declined as investors speculated that US interest rate cuts might occur sooner than anticipated, following a report from the WSJ indicating that Donald Trump is contemplating appointing an early successor to Jerome Powell.

US Building permits data MoM was -0.2, worse than expected, despite the survey expectation of an increase from the prior -0.2 to 0.0.

US New Home sales came in substantially lower. Last month was 743k, revised down to 722k. the estimate was for a lower number again this month of 693k, but the actual number came in much lower at 623k.

U.S. home price growth slowed to 2.7% in April, the weakest rate in nearly two years, as higher mortgage rates and rising inventory weighed on demand.

US Consumer spending up to mid-June has shown a mixed trend, with demand decreasing in general merchandise and department stores, while increasing in discretionary sectors such as food services and restaurants.

The labour market is showing signs of cooling, as job postings indicate a reduction in overall demand for workers, and there are indications of softening in ongoing jobless claims; however, layoffs have not been widespread thus far.

The Federal Reserve has suggested reducing the enhanced supplementary leverage ratio for large banks to a range of 3.5% to 4.5%. This move partially responds to requests from lenders to exclude certain assets, such as Treasuries, from the calculation.

The US Bond Market is Anticipating a Shift in the Coming Three Months

The US bond markets are on the brink of a notable transition in the next three months as Congress raises the debt ceiling again and the Treasury begins to ramp up its issuance. For several months, the US has been unable to issue significant amounts of Treasuries, instead depleting the cash balance at the Federal Reserve. Once the debt ceiling is lifted by Congress, the Treasury will commence issuing substantial amounts on a net basis, increasing spending and replenishing the cash balance. This could represent a pivotal moment to evaluate the bond market's capacity and readiness to absorb Treasuries, especially in light of persistent fiscal deficits, the anticipated approval of the administration's new spending bill, and ongoing long-term fiscal challenges. Much will hinge on the Treasury's issuance strategy: it may choose to focus on shorter-term bills rather than longer-dated coupon debt.

The Deadline for Postponing Reciprocal Tariffs Is Approaching

According to Kevin Hassett, Director of the US National Economic Council, trade agreements are anticipated following the tax legislation. This seems feasible as nations such as India, Vietnam, and Switzerland are nearing agreements with the US. In contrast, the EU and Japan remain significantly behind in their current negotiations. The tariff on the auto sector continues to hinder discussions with Japan, while the EU perceives the US as seeking unilateral concessions. Bloomberg has reported that the EU intends to implement retaliatory tariffs on US imports, even if the US establishes a baseline tariff on EU products. The prevailing expectation is that the US and EU will not finalize a deal prior to the July 9 deadline due to their conflicting views on tariffs and digital regulations. In this context, the US may impose tariffs of 50% on EU products or even threaten additional tariffs, while the EU could retaliate with tariffs on US goods worth EUR100 billion. This could lead to a renewed escalation of the trade war, although it may eventually de-escalate as seen in previous instances.

Japan is unable to accept the 25% tariffs on cars imposed by the US, stated chief trade negotiator Ryosei Akazawa, highlighting that the country's automakers manufacture more vehicles in America than they export to it.

Japan successfully auctioned two-year government bonds, achieving a bid-to-cover ratio of 3.9, the highest since January.

The results of the auction were described as "uneventful," with the cut-off price aligning with expectations and the bid-to-cover ratio surpassing that of the previous auction.

The Ministry of Finance plans to reduce the volume of 20-, 30-, and 40-year bonds offered in regular auctions by ¥3.2 trillion until the end of March 2026, while increasing the issuance of shorter-term securities beginning next month.

UK Think Tank Predicts Household Income Stagnation or Decline by 2030 - According to a report released on Thursday by the Resolution Foundation, the average income for British households is expected to increase by just 1% until 2030, due to rising taxes, energy costs, and a tightening of welfare support. Families with lower incomes are projected to experience a 1% decrease in their living standards. Conversely, pensioners may benefit the most, with their incomes anticipated to grow by 5%. The report also indicated that families with children are unlikely to see any increase in their income. This news follows a Citi/YouGov survey that revealed rising inflation expectations in the UK for the next 5-10 years.

The UK labour market has become a focal point in MPC discussions, following the ONS's alarming report earlier this month that indicated a staggering 109K decrease in payroll jobs for May. This significant decline marks the seventh consecutive month of job losses.

China’s rare earth magnet exports collapsed

Exports to the US dropped 92% YoY to 46 tons, which was less than 1/10 of what was recorded in March. The decline came before China had agreed to resume sending rare earths to American companies this month after US-China trade talks in London.

As a reminder, China produces ~90% of world’s rare earths, most of which are processed into magnets.

US companies are reluctant to invest:

The Richmond Fed has revised its expectations for manufacturing capital expenditures down to 20 points in June, which is the lowest level observed since the GREAT FINANCIAL CRISIS.

Reduced investments lead to diminished economic growth. It's as straightforward as that.

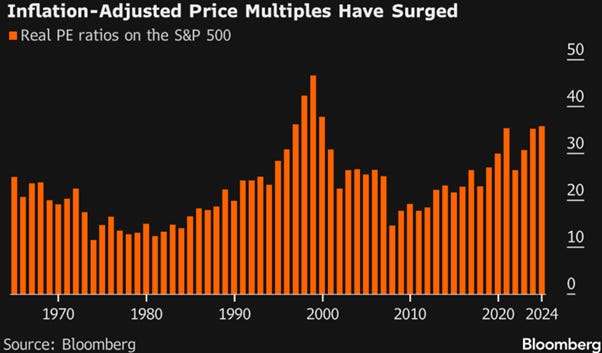

A Lost Decade Awaits the S&P 500 Due to Low Real Yields.

The inflation-adjusted earnings yield for US stocks is at its lowest since the beginning of the millennium, which will likely limit the returns for investors in the coming decade.

Currently, the S&P 500 Index has a challenging cyclically adjusted price-earnings ratio of approximately 36x. This results in a real earnings yield of 2.76%, marking the lowest level since 2000.

The earnings yield, adjusted for inflation, stands in contrast to a real yield of 2.03% on 10-year inflation-linked bonds, resulting in a narrow spread of only 73 basis points between the two.

This affects the potential returns that investors can expect to achieve from stocks.

Historical correlations indicate that, given the current inflation-adjusted earnings yield, investors are likely to experience a total return of -1.28% over the next ten years.

This indicates that, excluding dividends, fund managers are confronted with the possibility of capital losses on their investments.

The stock market has made a strong recovery after experiencing a significant drop in early April. However, the earnings outlook for the S&P 500 remains uncertain due to the effects of tariffs, leading the markets to potentially overlook the risk of declining earnings. Even a slight decrease in overall profits could negatively impact the S&P’s valuations.

The projected earnings for the S&P 500 this calendar year stand at approximately $265, suggesting a fair value of around 4,560 based on the median earnings yield of 5.8% that has been consistent for over thirty years.

Consequently, at the closing level of 6,025 on Monday, the index appears to be overvalued by 32%. Similarly, the Nasdaq 100, which promises growth driven by AI earnings, finds itself in a comparable situation. Its fair value is estimated at just 17,644, indicating it is overvalued by about 24%.

Moreover, stocks are contending with the challenge of rising inflation. Although the average increase in consumer prices this year has been 2.6%, zero-coupon inflation swaps are predicting inflation could accelerate to 3.14% within a year.

The Federal Reserve aligns with traders' expectations. In its recent economic projections summary released earlier this month, the Fed raised its core PCE forecast for this year by 0.3 percentage points to 3.1%. It now anticipates that inflation will not reach its target even by 2027.

The marginal stock buyer is ignoring several risks: a tenuous ceasefire in the Middle East, the possibility of the Fed maintaining its current stance longer than expected, and a slowdown in US economic growth.

Considering the current high valuations, stocks are likely to struggle over the next decade to achieve returns comparable to those of the past ten years. Indeed, past performance does not guarantee future results.

Anthropic won a key copyright case allowing the use of legally obtained books to train its Claude AI, but still faces a December trial over allegedly using pirated content.

Amazon will invest $4B to expand same- or next-day delivery to 4,000+ rural U.S. areas by 2026, intensifying competition with its e-commerce rivals.

FedEx beat Q4 estimates with $6.07 in EPS and $22.22B in revenue, met its $4B cost-cutting goal, and plans $1B more in FY26 savings. However, shares fell ~5% after forecasting weaker quarterly profits due to U.S. tariff impacts and duty-free policy changes. The company withheld full-year guidance.

Mars’ $36 Billion Kellanova Deal Hit by Full-Scale EU Probe, citing concerns the deal could thwart competition. The probe will assess the transaction's impact on the price of products for consumers. The EU has set an initial deadline of October 31 to decide whether to approve the deal.

Microsoft is set to announce major Xbox layoffs next week as part of broader company-wide cuts. This follows over 6,000 prior job losses and continued restructuring across its gaming and cloud divisions.

Nvidia is expanding its AI-focused cloud service with $10.9B in multiyear deals, challenging Amazon, Microsoft, and Google in high-margin cloud computing while continuing to supply them with its AI chips.

Polygon-based prediction market Polymarket is nearing a USD 200M fundraise at a USD 1B valuation, according to sources cited by The Information. The firm previously raised USD 45M in May 2024 and an unannounced USD 25M Series A

Shell said it has no intention of making an offer for BP.

The rejection indicates that Shell is obligated to adhere to the UK Takeover Code, which primarily prevents it from making a bid for a period of six months. According to UK takeover regulations, the six-month pause may be lifted sooner if BP gets an offer from a different bidder, encourages a new proposal, or if there is a "significant change" in circumstances.

Tesla down today as robotaxi can’t recognise school kids crossing the road. OUCH!!

Oil prices continued to rise following US President Donald Trump's announcement that his maximum pressure strategy on Iranian oil will persist, coupled with a government report indicating a significant drop in American crude stockpiles.

Data from the US government revealed that crude inventories fell for the fifth consecutive week, decreasing by 5.84 million barrels to reach an 11-year seasonal low, as US refiners increase crude usage to produce fuels in response to low pump prices.

Attention in the market will now shift to the upcoming OPEC+ meeting scheduled for July 6, which will determine the production policy for August, with Russia indicating a willingness to raise output if needed.

European natural gas prices have stabilised as the ceasefire between Israel and Iran remains intact, enabling traders to concentrate on increasing reserves for the upcoming winter.

Traders are consistently enhancing Europe's stockpiles, with storage facilities currently exceeding 56% capacity, and reduced demand from China may assist with these injections.

However, despite the replenishment of inventories, worries persist regarding possible heat waves, seasonal supply restrictions, and geopolitical tensions, particularly with a meeting scheduled between the US and Iran next week.

A previous dealmaker from Blackstone and a co-founder of Tether are in the process of raising $1 billion for a publicly traded cryptocurrency entity, according to sources familiar with the matter. Wilbur Ross and Gabriel Abed will take on the roles of vice chairs.

Chainlink and Mastercard partnered to allow Mastercard cardholders worldwide to purchase crypto directly onchain via a fiat-to-crypto conversion. Zerohash will provide compliance, while Swapper Finance, Shift4 Payments, XSwap, and the Uniswap protocol will support technical integration and user experience.

The Bank for International Settlements wrote that stablecoins ‘fall short of requirements to be the mainstay of the monetary system’ in a recent research report. The authors claim stablecoins do not qualify as money, failing tests of singleness, elasticity, and integrity as monetary instruments. The report described stablecoins as offering features such as programmability and fast transactions but highlighted concerns about risks to monetary sovereignty and crime facilitation. The report also advocated for tokenized platforms based on central bank assets as more suitable options for the future financial system.

Bill Pulte, the director of the US Federal Housing Finance Agency (FHFA) wrote on X that the regulator ‘will study the usage [of] cryptocurrency holdings as it relates to qualifying for mortgages’