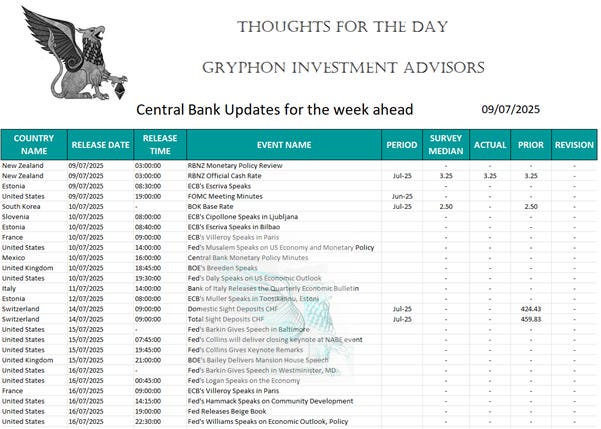

The president indicated that there will be trade updates regarding at least seven countries today.

The European Union is nearing a preliminary trade agreement with the US that would exempt commercial aircraft from certain tariffs, which would be advantageous for Airbus SE, and establish exceptions for some German automakers such as BMW AG and Mercedes-Benz Group AG.

Additionally, the agreement would alleviate burdens on spirits exports, and the EU is advocating for quotas and exemptions to reduce US tariffs on automobiles, car components, steel, and aluminium.

If an agreement is not reached by August 1, tariffs on almost all EU exports to the US would increase to 50%, whereas a successful agreement would secure a uniform tariff rate of 10%.

The EU is prepared to sign a temporary framework trade deal with the US, reported the Financial Times. It said Europe will accept the 10% baseline tariffs for now, and then proceed with further talks.

President Donald Trump pledged to continue his assertive tariff policy, emphasizing that he would not provide any further extensions on the country-specific tariffs scheduled to take effect in early August.

Trump also mentioned that he would impose an extra 10% tariff on imports from India due to their involvement in BRICS and could independently announce a new tariff rate on the European Union within the next 48 hours, driven by his dissatisfaction with the bloc's taxes and penalties aimed at US technology companies.

Pharmaceutical companies could incur tariffs as high as 200% on imports if they fail to relocate their production to the United States.

Aug. 1 is Trump’s Final Trade Deadline

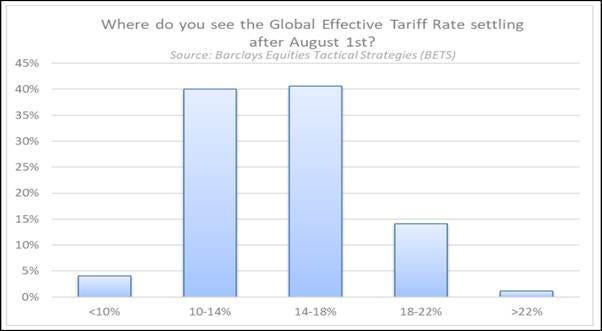

A presidential statement indicating that there would be no additional extensions following the new August 1 deadline had little effect. This should be significant. If the tariffs are implemented as stated, the average rate on all US imports will reach its highest point in a century, reminiscent of the levels observed during the Depression-era Smoot-Hawley Act.

If the nations that have not yet disclosed their tariffs also experience rates consistent with those revealed on April 2, then the total levies will be the highest since the time of Trump’s preferred president.

An effective rate nearing 20% would be considerably worse than anticipated at the beginning of the year.

Equity traders, on the other hand, appear to be converging on rates lower than this, suggesting confidence in substantial reductions.

A survey conducted by Alexander Altmann of Barclays Equity Strategies revealed near unanimous agreement among traders that the effective rate will stabilize above 10%.

U.S. ocean imports from China plummeted 28.3% YoY in June as tariff hikes prompted a shift to Southeast Asian suppliers, cutting China’s share of U.S. imports to 28.8% — down from 40% in July 2024.

In the past two years, global trade has experienced a 'shock' from China, with its export volumes increasing by 20%, compared to a 6% growth in the rest of the world. This marks China's most significant outperformance since the period following its accession to the WTO. A substantial portion of this export increase is directed towards emerging markets, which now represent more than half of China's total exports. This phenomenon is not solely attributed to low pricing; the strength of exports seems to persist even as negative export price deflators have eased over the last six months, indicating that quality is becoming an increasingly vital factor.

This raises the question: Is China exporting deflation to the rest of the world?

The minutes from the Federal Reserve's June meeting might reveal a split committee that is weighing the risks of inflation against a lowered growth forecast.

The president stated that Jerome Powell ought to "resign immediately" if he deceived lawmakers and criticized the Fed chair for "whining like a baby about non-existent inflation."

Trump referred to Powell as "terrible" and informed reporters that if the claims regarding misleading Congress about the renovations to the Federal Reserve's headquarters are accurate, it would warrant a prompt departure.

Trump accused Powell of "whining like a baby about non-existent Inflation for months, and refusing to do the right thing" in a social media post, and wrote "CUT INTEREST RATES JEROME — NOW IS THE TIME!"

According to the WSJ, Kevin Hassett, who is Trump's leading economic adviser, is becoming a prominent candidate for the position of Fed chair. There are concerns among those close to the president that the other leading candidate, former Fed governor Kevin Warsh, may not be in favour of reducing interest rates.

The US Supreme Court has allowed Trump to proceed with his plans to terminate hundreds of thousands of federal employees.

US Consumer Credit Growth Slowed - US net consumer credit grew $5.1 bn in May, a sharp slowdown from April’s $16.9 bn expansion. The market forecast had been for a gain of $10.5 bn.

American consumers' inflation expectations In June, for the upcoming year decreased by 0.2 percentage points to 3.02%. Meanwhile, the measures for three-year and five-year expectations remained unchanged from the previous month, as reported in the latest survey released by the New York Federal Reserve on Tuesday.

The NFIB Small Business Optimism Index fell to 98.6 in June from 98.8 the month prior. The small decline in business sentiment reflects ongoing concerns about the economic ramifications of shifting trade and immigration policies. On net, more firms raised selling prices, reduced capital spending, reported difficulties filling open positions and lowered expectations for economic growth.

China's producer prices experienced their largest decline in almost two years, overshadowing a slight increase in the Consumer Price Index (CPI).

China's producer prices have declined, exacerbating the deflation at the factory gate, as the producer price index dropped by 3.6% compared to the previous year.

This indicate signs of weakness in domestic demand, and policymakers need to persist in supporting consumption while being prepared to increase stimulus whenever necessary.

Liquidity in the Japanese government bond market has reached its lowest point in decades, heightening the risk of sudden increases in yields.

Yields on 30- and 40-year government bonds soared in May to their highest levels since they were first issued, following a 20-year debt sale that attracted the weakest demand in over ten years.

BUT…..

The recent decline in Japan's government bonds presents a significant opportunity for dollar-based investors, as currency-hedging more than doubles the nominal yield available.

Japanese 30-year sovereign bonds are experiencing a sharp sell-off due to concerns that the upcoming upper house election in July will lead to increased fiscal spending, especially considering the US's threat to impose a 25% tariff on Japanese exports. Despite a rise of approximately 80 basis points in just four months, yields of 3.07% remain unappealing, as they are still among the lowest in the developed world for similar maturities.

The Bank of Japan is not expected to increase rates soon, considering the economic pressures.

When factoring in the returns from foreign exchange hedging, the effective yield from these 30-year JGBs for dollar-based investors exceeds 7%. This positions the bonds as the highest-yielding option among the Group of Seven economies based on this metric.

This year has been challenging for duration strategies globally; however, in this instance, a yield surpassing 7% for dollar-based investors is currently very attractive and offers a strategic contrarian investment opportunity.

Amazon's Prime Day began somewhat slower. Sales dropped nearly 14% in the initial four hours compared to the beginning of last year according to Momentum Commerce.

Apple's box office hit: Apple's “F1” has surpassed $293M globally, becoming its highest-grossing theatrical release, driven by strong IMAX

Malaysia Airlines, AirAsia lock in 70 Airbus jets purchases. Low-cost carrier AirAsia, meanwhile, has signed a memorandum of understanding for 70 Airbus A321XLRs – 50 firm orders, with options for 20 more – in a deal valued at US$12.25 billion. Deliveries will commence in 2028 and continue through 2032,

Boeing delivered 60 aircraft In June, marking its strongest performance in a year and a half, partly due to the revival of US jet exports to China. This increase in deliveries allowed Boeing to re-enter the competition with its main competitor, Airbus, which delivered 63 aircraft during the same month.

IBM will release new chips and servers later this month, attempting to simplify enterprise AI deployment with power-efficient, secure systems.

Kuwait Investment Authority, which sold a $3.1 billion stake in BofA. The transaction was managed by Goldman Sachs Group Inc. and reflected a 1.5% reduction from Monday's closing price. This action comes after Warren Buffett's Berkshire Hathaway Inc. has been reducing its stake in the bank.

Merck is approaching a $10 billion agreement to acquire Verona, a biotech company specializing in lung diseases.

Meta acquired an approximate €3 billion share in EssilorLuxottica. Meta's investment strengthens the bond between the two companies, which have collaborated on the development of AI-driven smart glasses, and is in line with Meta CEO Mark Zuckerberg's dedication to AI.

Samsung forecasts sharp profit drop: Samsung expects Q2 profit to fall 56% YoY to $3.36B, missing estimates, as it struggles with weak foundry demand and delays in Nvidia certification.

SpaceX is reportedly preparing an offering that would value the company at $400 billion. The valuation takes into account various factors, such as the growth of its Starlink satellite internet division and the company's success in reaching new milestones with its Starship rocket initiative.

Virgin Atlantic plans to implement SpaceX's Starlink for onboard Wi-Fi throughout its entire fleet.

According to reports from the API, US crude inventories surged by 7.1 million barrels last week. If the EIA confirms this today, it will mark the largest increase in five months.

The United States has reduced its forecast for domestic crude oil output growth for the year 2025.

According to RBC Capital Markets LLC, global oil supply is expected to grow nearly four times quicker than demand in the upcoming half, which will put pressure on prices as inventories increase. They predict that Brent crude will drop to the mid-$50s per barrel next year.

LME copper prices fell as Donald Trump’s suggested 50% tariff on imports would effectively eliminate the opportunity for shipments destined for the United States.

Citi anticipates that prices will drop below $9,000 and indicated that US stockpiles will fulfil import needs for the remainder of the year.

Chile, the leading copper exporter to the United States, is currently waiting for details regarding tariffs. Both the foreign ministry of Chile and the chairman of Codelco have stressed that no official decision has been reached as of now.

Tether has revealed that its secret vault in Switzerland contains nearly 80 tons of gold, positioning it as one of the largest gold holders beyond banks and sovereign nations.

The BlackRock iShares Bitcoin ETF (NASDAQ: IBIT) now holds over 700,000 BTC. IBIT now holds more of the token than Strategy (NASDAQ: MSTR), which began accumulating the asset in 2021, currently holding 597,325 BTC.

Robinhood began discussions with regulators regarding its launch of tokenized equities in Europe, after introducing blockchain-based tokens representing US equities to EU retail investors. The Bank of Lithuania sought clarification on token structure. Robinhood aims to bring tokenized equities to the US and UK, pending regulatory approval.